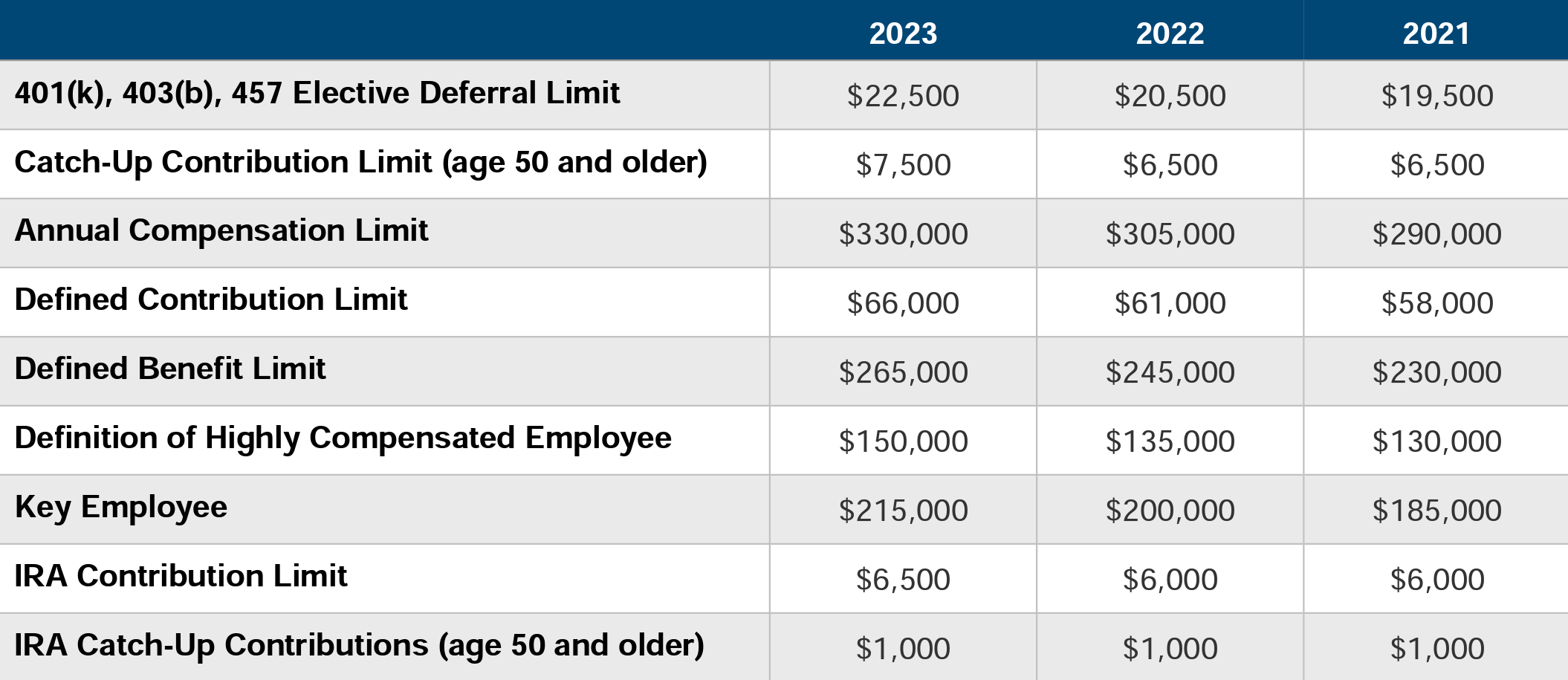

$19,500 in 2025 and 2025 and $19,000 in 2019), plus $7,500 in 2025;. The dollar limitation for catch.

Those 50 and older can contribute an additional $7,500. For 2025, the maximum amount of annual compensation that can be taken into account when determining employer and employee contributions is $345,000.

If you own more than 5% of the interest in a business or receive compensation above a certain amount (more than $155,000 in 2025 2), determined by.

2025 401k Limits Chart Tedda Ealasaid, While the official announcement will come in october, the irs contribution limit for retirement accounts will likely be a modest $500 increase for 2025, according to. Someone who owns more than 5% interest in the company regardless of how much compensation that.

2025 Hce Compensation Limit Nevsa Adrianne, The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. Most of the dollar limits, including the elective deferral contribution limit for 401(k), 403(b) and 457(b) plans, the annual compensation limit under 401(a)(17) and.

401k 2025 Maximum Angil Brandea, For individuals aged 50 or older, their limit is. If you're age 50 or.

2025 Highly Compensated Employee 401k Misha Tatiana, For individuals aged 50 or older, their limit is. The compensation covers recurring salaries from an employer and.

401k 2025 Contribution Limit Chart, While the official announcement will come in october, the irs contribution limit for retirement accounts will likely be a modest $500 increase for 2025, according to. If you're age 50 or.

401k Threshold 2025 Tamma Fidelity, The irs defines a highly compensated employee as: Final thoughts on 401k limits for highly compensated employees.

401k Employee Contribution Limits 2025 Storm Emmeline, If you're age 50 or. The main attraction of 401 (k) plans is the amount you can contribute;

2025 Roth 401k Limits Alice Brandice, For 2025, the irs limits the amount of compensation eligible for 401(k) contributions to $345,000. For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025.

Roth 401k 2025 Limits Davine Merlina, For 2025, the maximum amount of annual compensation that can be taken into account when determining employer and employee contributions is $345,000. The compensation covers recurring salaries from an employer and.

2025 Ira And 401k Limits Shea Florette, The limit on total employer and employee contributions for 2025. The 401 (k) contribution limits for 2025 are $22,500, or $30,000 if you're 50 or older.

Most of the dollar limits, including the elective deferral contribution limit for 401(k), 403(b) and 457(b) plans, the annual compensation limit under 401(a)(17) and.

2025 Carti Sample Paper Elements of book keeping and. Discover all playboi carti's music connections, watch videos, listen to music, discuss and download. Elements of book keeping and. Discover all playboi carti’s music connections, watch videos, listen to music, discuss and download.

Rnc Warns 2025 Ca What remains to be seen is whether the rnc threat to ban. Rnc chair ronna mcdaniel dismissed 2025 republican presidential candidate vivek ramaswamy's comments calling on her to resign during the third gop. Kirk alerted the rnc members to a new initiative of his group’s political arm, turning point action, that […]

2025 Preakness Field And Picks The 149th preakness stakes is this saturday, may 18, and that means you're probably in the market for the latest 2025 preakness stakes odds as well as picks. 2025 belmont stakes day race and picks. Before making any 2025 belmont stakes picks for the 156th run for the carnations, you […]